Understanding Order Flow Pt 2

How Participation Strengthens, Fades, or Fails

In Part 1, we established that aggression alone does not determine outcome.

What gives aggression meaning is how it unfolds over time.

Speed, Duration, and Acceleration

Aggression’s weight varies by temporal unfolding.

The same aggressive activity can communicate very different information depending on how it unfolds over time.

Three dimensions matter most:

Speed: how quickly participation appears.

Duration: how long pressure persists.

Acceleration: whether participation is building or fading.

Together, these determine whether the auction is strengthening or weakening.

Speed: How Quickly Does Participation Appear?

Speed reflects urgency.

When aggressive orders appear suddenly, rapid lifting of offers or hitting of bids, it signals that participants are seeking liquidity now, not passively waiting.

This type of activity often emerges:

As price breaks from a level.

During stop-driven moves.

When positioning shifts abruptly.

With news headlines.

Slower aggression, by contrast, usually reflects probing behavior. Participants engage, observe the response, and adjust without committing fully.

Duration: How Long Does Pressure Persist?

Duration gives aggression its meaning.

A brief burst of activity can move price, but it does not necessarily establish control. Sustained pressure, maintained over time, carries far more information.

Let’s illustrate the difference with two moves that look similar on the chart.

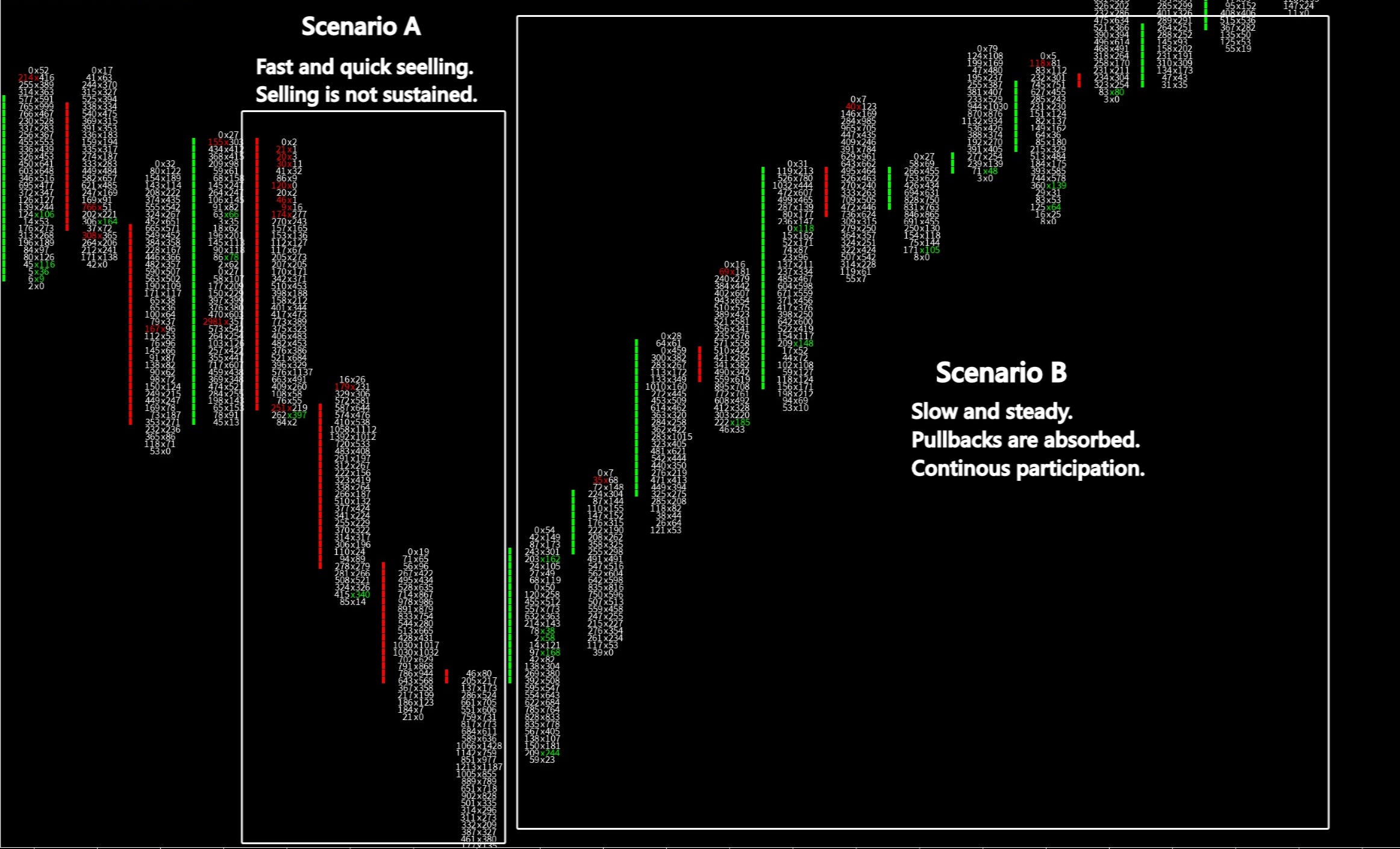

Scenario A:

Aggressive buying appears suddenly.

Delta spikes for 5–10 minutes.

Price jumps quickly.

Participation fades almost immediately.

The move reverses.

This type of behavior is often reactive, driven by stops, hedging, or news-driven headlines positioning.

Scenario B:

Buying builds gradually.

Delta increases steadily over 45–60 minutes.

Pullbacks are absorbed.

Participation remains consistent.

This reflects sustained initiative. Both may push price higher, but they represent very different conditions.

Longer-duration participation reflects willingness to hold risk and increases the likelihood of follow-through.

Short-duration participation is often reactive (stops, hedging, temporary imbalance) and tends to exhaust quickly.

Acceleration vs. Decay

This is where interpretation becomes more nuanced.

The more useful question is not whether aggression exists, but whether it is becoming more effective or less effective over time.

In healthy, sustained movement, participation does not just appear.

It Builds.

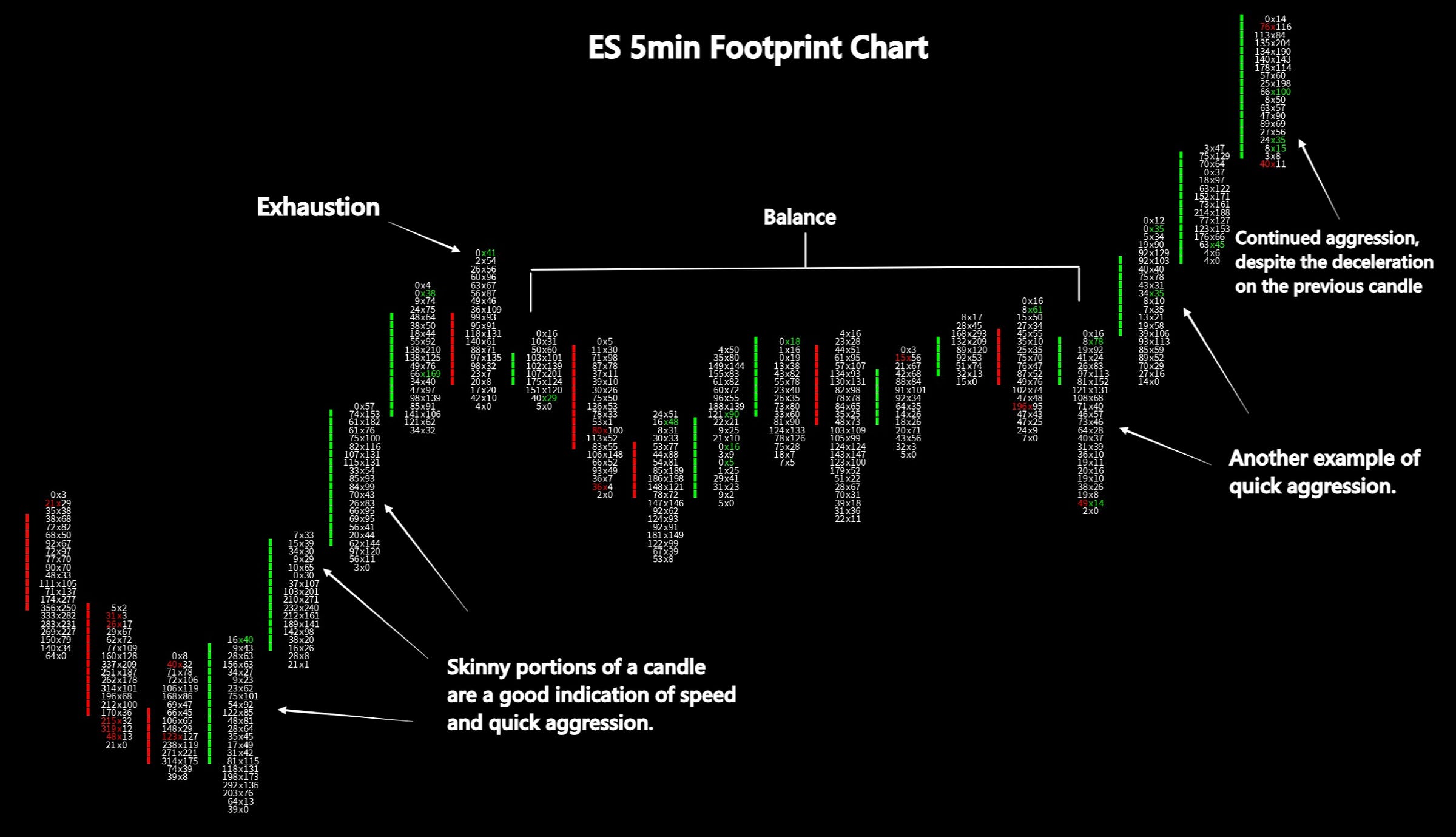

Acceleration tends to show up as:

Repeated pushes producing similar or greater progress.

Execution becoming faster as price moves (usually due to triggered stops).

Size appearing consistently rather than sporadically.

Decay appears when that relationships begins to break down.

Participation may still be present, but its impact diminishes.

Common signs include:

New aggression producing less prive progress than prior pushes.

Slower or more fragmented execution.

Price becoming less responsive despite continued effort.

A Takeaway

Order flow is not static.

Reading that evolution, rather than reacting to isolated moments… is what allows order flow to provide context instead of noise.

Exhaustion

Exhaustion is not the absence of participation.

It is the failure of participation to attract continuation.

Exhaustion develops after a sustained move, when aggressive traders continue to act, but no new participants step in behind them to extend price further in that direction.

Orders are still executing.

Aggression is still present.

But the market fails to recruit the next wave of initiative needed to continue repricing.

Each push requires more effort and produces less progress.

That imbalance, increasing marginal effort with diminishing continuation, is the defining feature of exhaustion.

Price continues to trade, but advancement slows.

Not because interest disappears, but because additional participation no longer appears to support further movement.

A Simple Takeaway

Exhaustion is information, not instruction.

It tells you that the side driving the move is running out of follow-through.

What happens next depends entirely on context:

If the opposing side responds with initiative, price may reverse

If neither side asserts control, price may rotate or rebalance

In some cases, the market pauses before continuation resumes later

Exhaustion highlights vulnerability, not outcome.

Putting it all together:

The Relationship Between Absorption and Exhaustion

Absorption and exhaustion often appear together, but they describe different stages of the auction.

Absorption is the mechanism, passive liquidity responding to aggressive flow.

Exhaustion is the state that develops when that response persists.

A common sequence looks like this:

Aggressive buying pushes price into a level.

Passive sellers absorb that flow.

Buyers continue to press.

Price stops advancing.

Exhaustion develops.

At this point, the market is no longer progressing because pressure alone is no longer sufficient.

Not because price must reverse, but because the side driving the move has lost efficiency.

Order flow allows you to observe this transition as it forms, rather than reacting after structure has already changed.

Hopefully I hammered this point enough for it to make sense!

Forced vs. Discretionary Flow

Not all order flow derives from the same motivation.

Some participants choose to trade. Others are required to trade.

Understanding the difference between these two types of flow adds an important layer to order flow interpretation.

Discretionary Flow

Discretionary participation reflects choice. Which means:

Traders initiating new positions.

Participants adding or reducing exposure.

Funds expressing a directional view.

This type of flow is opinion-based. Participants engage because they believe conditions are favorable.

When discretionary buyers are in control, participation tends to be steady and responsive, with pullbacks remaining contained as long as conviction holds.

Forced flow

Forced participation reflects obligation rather than opinion.

Typically, what it includes is:

Short covering after stops are triggered.

Long liquidation during downside breaks.

Dealer hedging related to options exposure.

Risk-driven inventory reductions.

Forced flow is mechanical.

Participants are responding to risk or obligation constraints rather than opportunity.

This type of activity often appears suddenly, produces sharp bursts of aggression, concentrates near key structural levels, and loses influence once the obligation is satisfied.

Why the Distinction Matters

Two price movements can appear similar on a chart while being driven by very different forces.

A rally driven by discretionary participation reflects initiative and can persist.

A rally driven primarily by short covering reflects resolution of risk and may stabilize once that process completes.

Order flow simply helps frame a more useful question:

Is this movement being driven by choice, or by necessity?

It is not always clear. But with experience, traders can make increasingly reliable inferences.

What Order Flow Is Used For

Order flow does not remove uncertainty.

It makes behavior more legible.

It helps explain whether participation is productive, fading, or being absorbed as structure develops.

That context allows price action to be interpreted rather than assumed.

Why Order Flow Requires Interpretation

Price prints are facts.

Order flow is contextual.

Two traders can observe the same data and reach different conclusions because meaning comes from structure, duration, and response.

Aggression alone is insufficient.

The same activity can represent initiative, liquidation, hedging, or short covering.

Order flow does not deliver certainty.

It requires interpretation.

You are weighing:

Effort against result.

Participation against acceptance.

Pressure against response.

That process improves with observation and experience.

This post establishes the foundational framework for understanding order flow.

Future posts will focus on the tools used to organize and interpret this information in real time.

If you have questions or thoughts on this topic, feel free to leave a comment under the publication.