Options Basics For Day Traders

An introduction to calls, puts, and contract mechanics

Let me start with something important.

Options are not as complicated as you think they are.

They only feel complicated because most explanations are written by Academics or Long-term investors (neither care about intraday movement).

This post strips options down to what actually matters for day traders.

Stocks vs. Options vs. Exposure

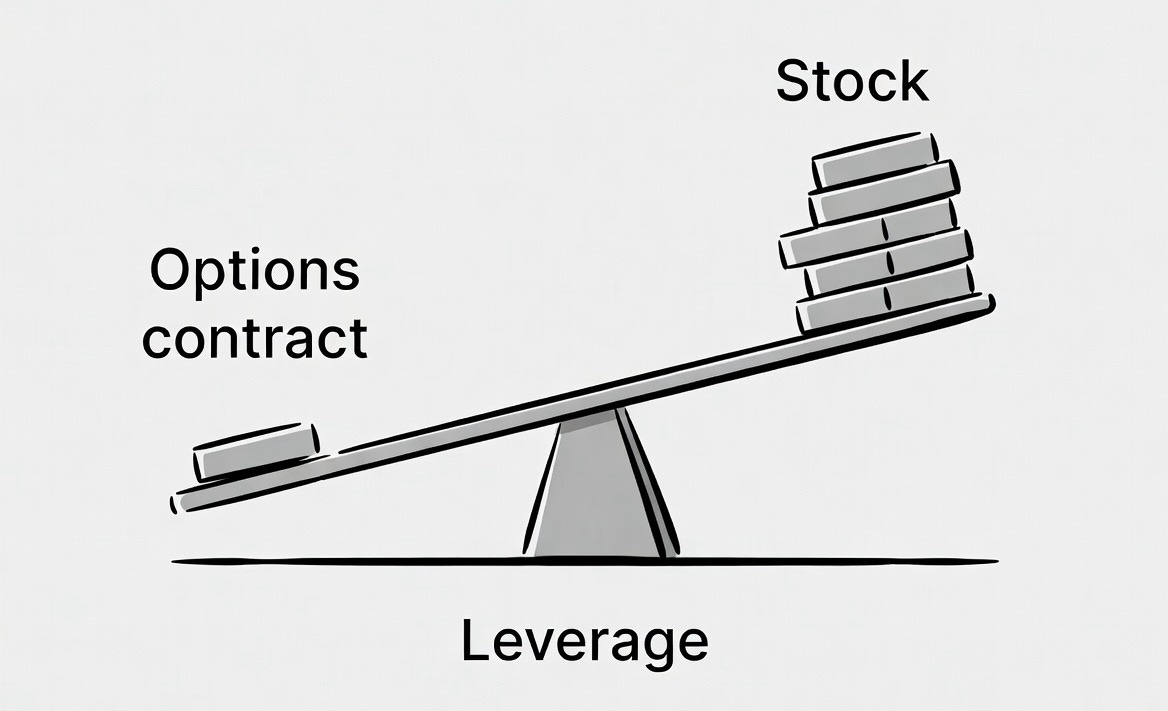

When you buy a stock, you are buying ownership. One share represents a small piece of a company. Your upside and downside are linear. If price goes up, you make money. If it goes down, you lose money.

Options are different.

An option is not ownership. It is a contract. More specifically, it is a contract that gives the buyer the right, but not the obligation, to transact at a predefined price before a certain time.

This distinction matters.

Stocks expose you directly to price.

Options expose you to conditions around price.

Direction still matters, but so do time and volatility. Even if price goes your way, an option can lose value if it does not move fast enough or far enough.

For day traders, this is both the danger and the opportunity.

Contract Size: What One Option Actually Represents

One options contract typically represents 100 shares of the underlying.

This is foundational.

When you see an option quoted at $2.50, that price is per share. The contract costs $250, plus commissions. Gains and losses follow the same multiplier.

Index options like SPX are cash settled and use a fixed multiplier, but the principle is the same: you are trading a defined unit of exposure.

This is why options can look inexpensive while carrying significant risk. The premium may be small, but the exposure is not.

Call Options: What You’re Actually Trading

In simple terms, buying a call option gives the buyer the right (not the obligation) to buy 100 shares at a specific strike before expiration.

If you buy a call, you are expressing a bullish view. You are saying that you expect price to move higher, beyond the strike, within a certain timeframe.

But here is what matters for day traders.

When you buy a call, you are not planning to exercise the option.

You are buying and selling back the option in the same session.

Example in plain terms:

Underlying: SPX

Current price: 6900

Call strike: 6925

Expiration: Today

If SPX moves above 6925 before expiration, that call gains intrinsic value. If it does not, the option expires worthless.

The key point is this: you are not required to buy SPX. You are buying the right to buy it, and most retail traders never exercise that right. They trade the option itself.

Put Options: The Same Logic, Inverted

Buying a put option gives you the right to sell 100 shares at a specific strike before expiration.

Exposure benefits from downside movement.

No stock ownership is required.

Let me give you another example:

Apple is at $100.

You buy a 0-DTE 95 put for $0.50

10minutes later apple is trading at $97.5

You sell back the put for $0.75

You made 25 cents per share or $25 dollars

Again, most puts are never exercised. They are traded.

Buying vs. Selling Options

This is where a everyone gets confused.

Every option has two sides: a buyer and a seller.

Buying Options

You pay a premium (to enter into the position)

Risk is defined (you can’t lose more than you paid)

You need movement in your direction

Time works against you

Most day traders choose to buy options.

Selling Options

You receive premium (you get paid to put on the trade)

Risk is technically unlimited

Time is on your side (even if there is movement against you)

However… don’t think selling options is “easy income.”

It is volatility trading, inventory management, and risk control.

If you’re newer or trading intraday momentum, believe me, selling naked options without structure is a fast way to learn expensive lessons.

For context’s sake, assume buying calls and puts only.

How to Read an Options Chain

For day traders, an options chain is simply a menu of time and strike combinations. Everything else is secondary.

Options chains overwhelm people because there are many numbers to look at.

Instead, you need to focus on what actually matters for day traders.

1. Expiration

This defines time risk. Day traders typically focus on:

0-DTE for indices

Weekly options for single stocks

Why? Liquidity, tighter spreads, faster response to price.

2. Strike Price

This is where the contract becomes sensitive.

Ask yourself one question:

“Where do I see price going?”

Then buy the strike before that price.

3. Bid / Ask

Typically a non-issue if trading high liquid options like SPX, SPY, QQQ.

One important caveat: Wide spreads = bad fills.

This will be an issue with single stocks and on high volatility days.

If you can’t enter and exit cleanly, the setup doesn’t matter.

4. Volume vs. Open Interest

Volume = activity today

Open Interest = open contracts from yesterday

Day traders care far more about volume.

No volume = no participation = no trade.

Moneyness

Moneyness describes where the option strike sits relative to current price.

In-The-Money (ITM)

A call with a strike below current price, or a put with a strike above it.

Higher delta. Moves more like stock. More expensive. Less decay sensitivity.

Rarely used by day traders.

At-The-Money (ATM)

A strike near current price.

Best balance of delta and cost. Tighter spreads. Most responsive intraday.

This is where many professional day traders operate.

Out-Of-The-Money (OTM)

A call above current price, or a put below it.

Cheap. Low delta. High decay. Requires strong movement.

OTM options are not bad. They are just unforgiving.

Avoid oversizing because contracts look cheap.

Avoid holding through decay.

Avoid treating options like lottery tickets.

Cheap does not mean low risk.

Time and Expiration: The Invisible Variable

This is likely the most important piece of info…

Options are wasting assets.

Every option has an expiration, and as that moment approaches, time value decays. This decay accelerates as expiration gets closer.

This is especially relevant for 0DTE options, which are popular among day traders. They are highly sensitive, but unforgiving. Price must move, and it must move soon.

I like to think of option sellers as the casino and option buyers as the players. The house has the edge of time and the reality is that most options expire worthless.

How Options Are Priced (In Very Simple Terms)

An option’s price is made up of two parts.

What it is worth right now, and what it might be worth later.

That is it.

The first part is called intrinsic value.

The second part is called time value.

If a call option is already in-the-money, part of its price comes from the fact that it could be exercised profitably right now. If it is out-of-the-money, that part is zero.

Everything else in the price is time.

Time represents possibility. The possibility that price moves far enough, fast enough, before expiration.

The more time an option has, the more expensive that possibility is. As expiration approaches, that possibility shrinks, and the option loses value even if price does not move.

Volatility matters here too, but you can think of it simply as this:

the faster and more violently the market moves, the more that possibility is worth.

This is why two options with the same strike can have very different prices on different days. Not because the strike changed, but because the market’s expectation of future movement changed.

For day traders, the takeaway is straightforward.

You are not just paying for direction.

You are paying for time and movement.

If price stalls, time keeps ticking.

And time always gets paid.

Why Options Matter to ES Day Traders

Even if you never trade an option, options still trade you.

SPX options influence dealer positioning. Dealer positioning influences hedging flows. Hedging flows influence futures.

This is the bridge.

Understanding calls, puts, strikes, and expirations gives you a framework to interpret why ES behaves the way it does around certain levels, especially on high-volume days or near expiration.

This is not about prediction. It is about context.

The Right Mental Model for Day Traders

If there’s one thing I want you to remember. It’s that options are a tool.

Your edge still comes from: Context, timing, structure and risk management.

Options simply allow you to express that edge with:

Defined risk

Capital efficiency

The goal of this post is not mastery, but orientation. To replace vague awareness with a clear mental structure.

In future posts, we will build on this foundation. We will talk about Greeks, positioning, and how options markets interact with futures in real time.

For now, let this be enough.

If you misunderstand options, you will misuse them. If you understand them, they become one of the cleanest tools for expressing intraday intent.