Implied Volatility vs. Historical Volatility

How Markets Price the Past vs. the Future

Markets operate with two very different forms of volatility, each answering a different question. Understanding that distinction matters, especially once options enter the picture.

Two Different Questions the Market Is Answering

Historical volatility and implied volatility are related, but they are not interchangeable.

They exist to answer different questions.

Historical volatility explains what price has done.

Implied volatility explains what the market expects price might do.

That’s the core distinction.

Historical Volatility Is Context

Historical volatility is backward-looking by definition. It is derived entirely from realized price movement.

It tells you:

How active or quiet the market has been.

Whether price has expanded or compressed.

Information about the recent regime.

What it does not tell you is how much risk the market is currently pricing into the future.

For day traders, historical volatility is useful as context. It helps frame whether today’s movement is large or small relative to what the market has recently experienced. It provides reference, not expectation.

TBH… historical volatility is not that useful for my day trading.

Implied Volatility Is Pricing

Implied volatility exists because options exist.

It is not observed directly from price. It is inferred from option prices and reflects how much movement is being priced into the market going forward.

Implied volatility does not describe direction.

It does not describe timing or prescribe how fast the market will move..

It describes magnitude.

In simple terms, implied volatility tells you how far price is expected to move within a given timeframe, probabilistically. It does not tell you how price will get there.

This is why implied volatility is central to options pricing and secondary to price itself.

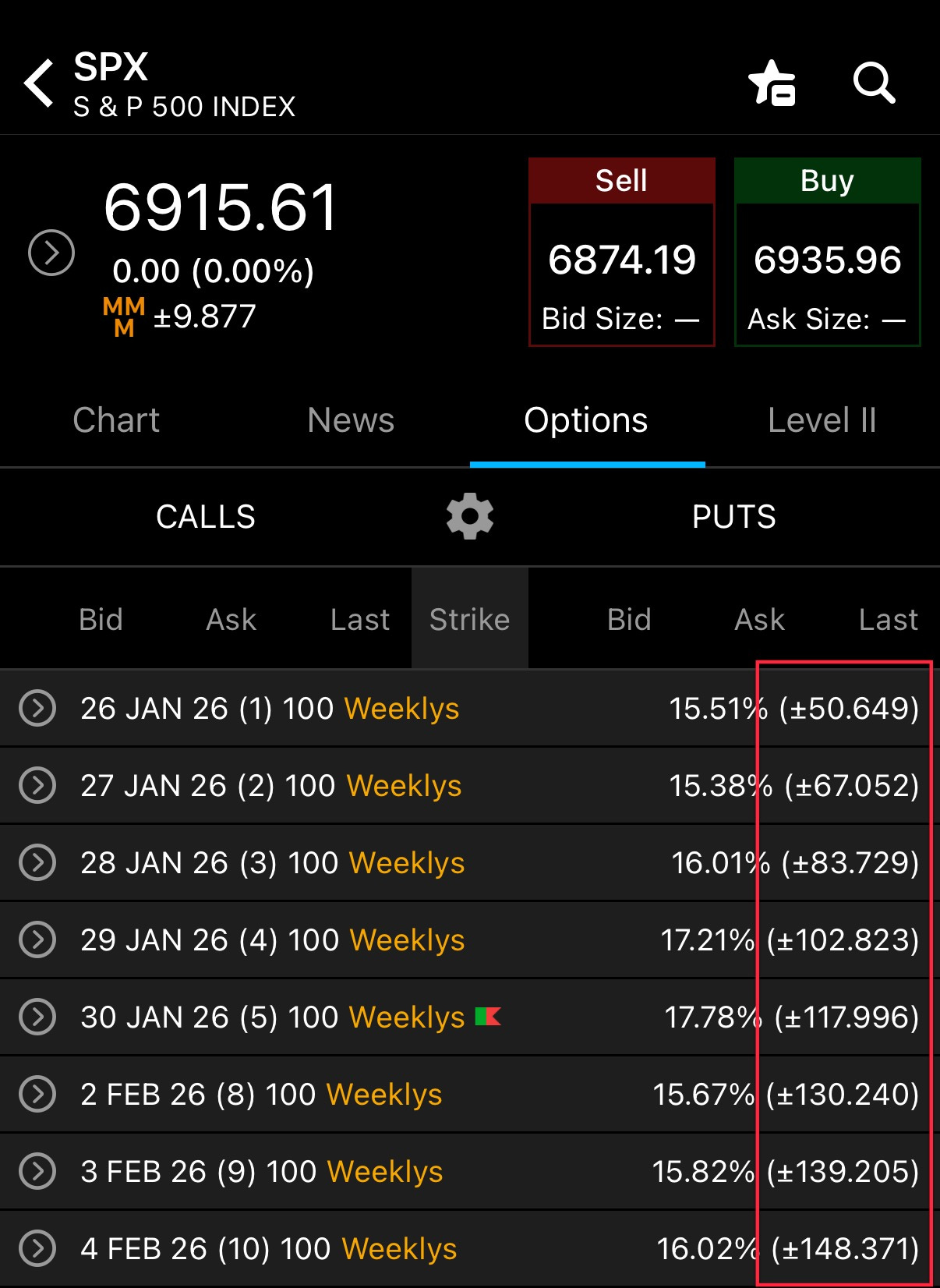

In the image above, the highlighted zone is the markets expected move based on options pricing from today until that day’s expiration.

Can you see the day when IV jumps?

Why Implied Volatility Matters to Day Traders

As a day trader, implied volatility becomes part of the daily backdrop.

It defines the expected range for today.

It helps frame how much movement the market is pricing in.

It provides context around upcoming events, such as economic releases or known catalysts.

For example, if an upcoming NFP release is priced with only slightly higher implied volatility than the prior day, it suggests the market is not expecting the report to be a major catalyst.

That positioning can matter. When expectations are muted, outcomes that meaningfully deviate from consensus can have a larger impact, not because the news itself is extreme, but because the market was not positioned for it.

Looking at implied volatility is not about predicting where price will go. It’s about understanding how much uncertainty is being priced and how wide the distribution of outcomes is expected to be.

That framing matters regardless of whether you trade futures, options, or both.

Implied Volatility Changes Throughout the Day

Implied volatility is not static.

It expands and contracts throughout the session as information changes, time passes, and risk is re-evaluated. Sometimes IV changes alongside price. Sometimes it changes while price barely moves.

Because IV is dynamic, it’s worth monitoring intraday, not just at the open.

Watching how implied volatility behaves relative to price can add context to movement, especially when markets are compressing, accelerating, or approaching key events.

Expectation Is Not Obligation

An expected move is a probability, not a promise.

If implied volatility suggests a ±50 point move, that does not guarantee price will move 50 points. It also does not mean that if price reaches that level, it must reverse.

Expected moves often work because markets tend to price risk efficiently. But efficiency does not mean certainty.

The value of implied volatility is not in prediction. It’s in preparation. It frames uncertainty, not outcomes.

Looking Ahead

Implied volatility becomes even more important as expiration approaches.

It interacts directly with gamma.

It shapes how price responds to order flow and positioning.

This is also why traders coming from futures can underestimate volatility risk when they step into options. The mechanics change, even if the underlying market is the same.

Volatility does not tell you where price will go.

It tells you how uncertain the market is, and how that uncertainty is being priced right now.