A New Beginning

For those seeking a deeper understanding

I didn’t come to trading from a finance background.

No Ivy League degree. No Wall Street internship.

I was a self-taught software engineer, grinding in Silicon Valley. Building code for apps that billions scroll through daily. Features you probably use without thinking twice.

It was steady. Predictable, in a way. But with trading? That sparked something else.

Curiosity, at first. Then greed crept in….visions of financial freedom, escaping the 9-to-5 hamster wheel. Liberty, I called it. The kind where your time is truly yours.

I figured, like coding puzzles I’d cracked before, trading would just... work out. Plug in, learn the syntax, output profits.

Boy, was I wrong….

I did not start in futures.

I did not start with order flow.

I did not start with options data.

I started with stocks, like most people do (or did 10yrs ago). Out of curiosity, and if I am honest, a mix of greed and the hope that trading might eventually buy me some form of freedom.

Then came penny stocks, chasing those monster candles.

Then learned technical analysis.

Then options.

Each step felt like progress. Each new tool felt like the missing piece. The edge that would finally make things click.

It never was.

Looking back, the problem was not effort. It was how I was taught to think about markets.

Most traders start by learning what price did.

Candlestick patterns.

Fibonacci levels.

Historical setups that “worked” in backtests.

You find a pattern. You define a stop. You define a target. You wait.

Either take profit or stop out.

Clean. Mechanical. Comfortable.

And completely blind.

Blind to who is actually participating today.

Blind to why price is moving right now.

Blind to whether the conditions that made that pattern work last month even exist this morning.

Markets are not static systems.

Every day, different participants show up with different objectives, different constraints, and different positioning. Some days liquidity is thin. Some days it is crowded. Some days dealers are short gamma and forced to chase price. Other days they are long gamma and actively suppressing movement.

Yet most retail traders trade the same setup, the same way, every day, regardless of context.

They place the trade.

They sit on their hands.

They wait for either TP or stop.

No ability to adapt.

No reason to skip.

No reason to size up.

No framework for flipping when the market proves them wrong.

For me, this is not trading. That is hoping.

My engineering background made this increasingly uncomfortable.

When a system fails, I want to know why.

When assumptions break, I want to see where.

So I kept digging.

I paid a lot of market tuition, especially in options. I am genuinely glad that 0DTE options were not around when I started. I would have blown up faster and more efficiently.

Eventually, I heard about futures.

So I took Market Profile courses.

Then order flow courses.

Then tried to apply what I was taught was “what works.”

Sometimes it worked.

Other times it did not.

Like everyone who stays in this long enough, I paid for the lessons.

Then came psychology. The books. The courses. The introspection. The belief that if I could just fix myself, the strategy would magically fall into place.

All of it helped. Just not in the way I initially expected.

Very early on, one conviction became clear to me: I never wanted to rely on someone else to tell me when to buy or sell.

Because what happens when that person disappears?

What happens when the guru stops posting, stops trading, or blows up?

You end up back at square one, hunting for the next voice to follow.

That path never appealed to me.

I did not want signals. I wanted understanding.

I wanted an internal compass, not an external crutch.

That is when I started building.

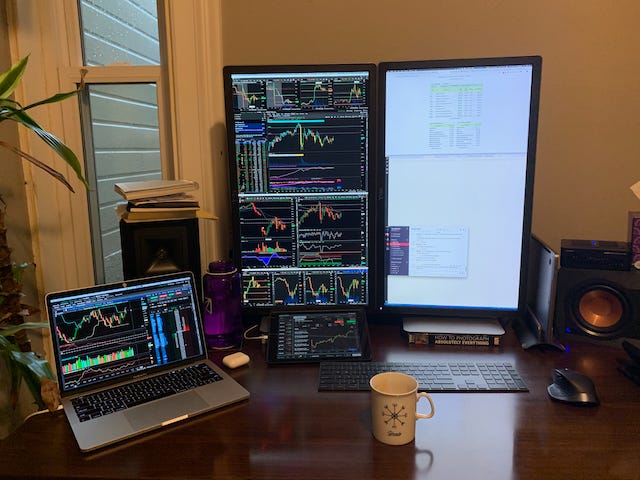

I automated what I could. I built tools to remove discretion where discretion did not belong. In 2020, once I started trading futures seriously, I founded Sierra Trading with a very specific goal: reduce the number of decisions I had to make in real time, and make the remaining ones clearer.

I spent years backtesting, forward testing, building servers, writing code, staring at charts, breaking things, rebuilding them, and repeating the process. I am deeply dedicated to this craft, and I have learned far more from what did not work than from what ever did.

Then 0DTE options entered the picture.

I started hearing about market maker hedging dynamics.

Dealer positioning. Gamma. Charm.

So I dug into it. And eventually, I built tools for that too.

Fast forward.

I’ve had a big realization throughout this journey.

Something that seems overstated:

There is no single tool that will consistently navigate markets for you.

Markets change.

Volatility regimes change.

Presidents change.

Wars happen.

Pandemics happen.

Any tool that claims to work all the time is lying.

What actually matters is context.

Not predictions.

Not certainty.

A framework.

An IF → ELSE → THEN process that evolves throughout the day, where the “IF” is always the highest-probability scenario given the current context, and your experience exists to help you see that context more clearly.

If dealers are forced to hedge, price behaves one way.

If liquidity is thin, it behaves another.

If order flow confirms, you press.

If it does not, you reduce risk or step aside.

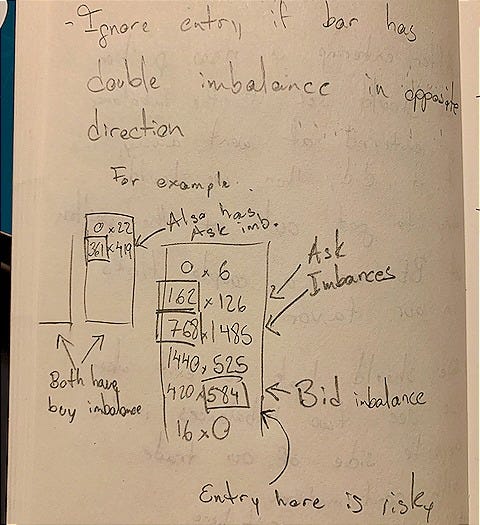

This is where going beyond candlesticks matters.

Candles tell you what happened.

They do not tell you why it’s moving now.

Options data is extremely powerful. Just not for everything.

Order flow is incredibly effective. But without experience, it is just numbers on a screen.

Technical analysis has its place too, even if I joke about it more than I should.

None of these are magic. All of them are contextual.

Options data can be very useful for equities. Much less so for certain commodities. Does that mean you avoid trading them entirely? That is one choice.

Another is adaptation.

Lean on order flow. Lean on structure. Lean on behavior.

So the real question becomes: What kind of trader do you want to be?

Someone who trades a single pattern and hopes conditions never change?

Or someone who understands why something makes sense in the first place, and can adapt when it stops making sense?

This newsletter exists for the second group.

Over the years, I have built a community around tools, not signals. Around versatility, not rigid rules. Around traders who want to level up instead of outsourcing their thinking.

I am not here to hand you entries.

I am here to help you see why an entry makes sense.

Why a stop should be tight here and wider there.

Why a failed trade might actually be a signal to flip.

Why some days you size up and others you do nothing at all.

I do not plan on sharing every edge I have. That would not even be useful. What I do want is to create a place where traders of all experience levels can consistently take something away. A place built by someone who has already been through the ringer and can tell you what is actually worth focusing on.

Going forward, I will be writing slow, methodical, educational pieces that build on each other, from beginner to advanced, across topics like:

Futures markets

Market fundamentals

Market structure

Options and dealer positioning

Order flow

Performance tracking

Psychology and execution

Quant thinking

Programming and backtesting

This will take time. Years of accumulated experience do not compress cleanly into a few posts.

The goal is simple.

Cut through the noise.

Provide detailed education.

Help you build systems that make sense for you.

No shortcuts.

No signals.

Just learning how to think clearly about markets.

If that resonates, you are in the right place.